Japan stocks fell the most among Asian markets Thursday, while Australian stocks hit a record high, helped by a boost from mining shares. The Japanese yen remained near 34-year lows.

Japan's Nikkei 225 fell 1.46% to 40,168.07, while the broader Topix shed 1.73% to close at 2,750.81.

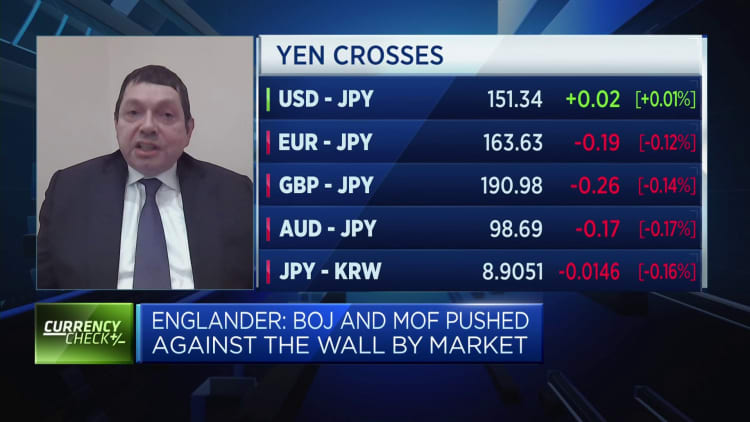

The Japanese yen was trading at 151.41 against the dollar a day after hitting 151.97 — its weakest level against the greenback in 34 years.

The multi-decade lows of the yen fueled market speculation of a potential government intervention to support the currency. Japan's finance minister Shunichi Suzuki indicated earlier in the week that measures to "respond to disorderly FX moves" will not be ruled out.

In Australia, the S&P/ASX 200 ended 0.99% higher at 7,896.90 after hitting an intraday record high of 7,901.20. The index was higher for a second straight day. Heavyweight miners rose including Rio Tinto up 0.7% and BHP Group up 1.4%.

China's CSI 300 rose about 0.52% at 3,520.96. It was reported that China's central bank may restart treasury bond buying, a monetary policy tool it has not used in more than two decades.

South Korea's Kospi ended 0.3% lower at 2,745.82. The smaller cap Kosdaq dipped 0.13% to 910.05.

Hong Kong's Hang Seng index gained 1%, with the Hang Seng tech index up 2.5%.

The U.S. benchmark S&P 500 index closed at a record higher Wednesday and headed for its best first quarter since 2019. The index gained 0.86% to close at 5,248.49, while the Dow Jones Industrial Average rose 1.22%.

Both the S&P 500 and the Dow ended three-day losing streaks. The Nasdaq Composite rose 0.51%.

— CNBC's Lisa Kailai Han and Alex Harring contributed to this report.